Surprise Jump in China Exports – WSJ.com.

The Wall Street Journal enjoys cheerleading the Chinese economy. Here’s the lede:

China’s exports put in a stronger-than-expected performance in October, a positive sign not only for the world’s second-largest economy but also for global demand.

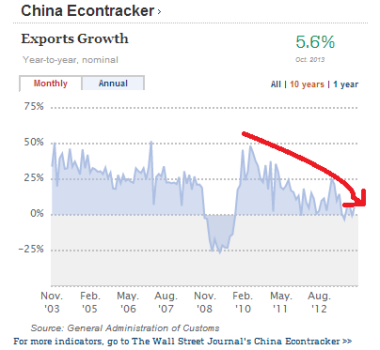

The first part is an adequate reporting of the data, but the second is poor analysis. One month’s data does not constitute a positive sign particularly in the world of foreign trade. Chinese exports exceeding the consensus forecast is not bad news for the world economy, but stating that it is a “positive sign” constitutes hype.

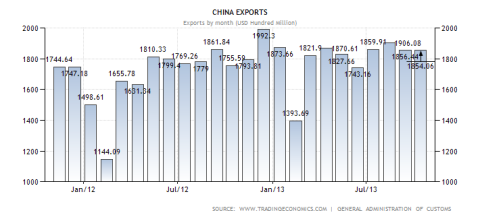

The real Chinese export picture is much more complex. As you can see, despite the MFP’s best efforts to draw conclusions from one month’s worth of data, the truth is that export growth is slowing. This shouldn’t be surprising considering lackluster growth in China’s three largest markets, and yet here we are.

In October Jobs Report, U.S. Hiring Picks Up Strongly – WSJ.com.

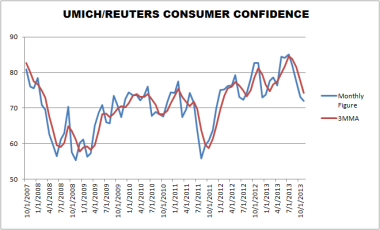

US consumer sentiment at 72.0 vs. 74.5 estimate.

The headlines read that consumer confidence unexpectedly dropped in November. This begs the questions, “Who expected a rise?” Diving further into the article we find that an amorphous blob known as “economists.” In light of a stagnant labor market and a government “shutdown,” I was initially surprised that the consensus an increase until I read the rest of the article.

Consumer confidence is dropping sharply among those earning less than $75k per year while high earners remain confident due to the rising stock market. Economists generally exist in a bubble with their upper middle class colleagues, and to this group things are great. Their 401(k) plans and incomes have steadily increased, so it is very difficult for them to recognize the dire straits that the rest of the country finds itself in. You would think that three decreases in a row off the July peak would have made them a bit more cautious in forecasting November’s number, but then you’d be wrong. If the whole consensus missed, then nobody missed. There’s safety in the herd.

S&P lowers France credit rating, cites slow reform pace | Reuters.

S&P cuts France’s sovereign credit rating.

S&P Cuts France’s Credit Rating by One Notch to Double-A – WSJ.com.

Rarely does an agency ratings cut lead to a marked change in yields. Today, the S&P cut France’s rating a half a step, and the market yawned. On the flipside, the market is equally apathetic when ratings are increased. When Fitch raised Spain a half a notch last month, yields barely budged. None of this matters because France will never pay back all of this debt just like its fellow industrialized economies in the EU, North America and Asia.

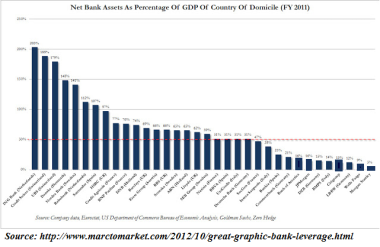

ECB on collision course with Germany on banking union – FT.com.

The Financial Times is hyping this disagreement between Germany and the ECB regarding centralized bank supervision. There is no collision, and everything is fine. Germany will simply not allow an EU institution to have control over its banking industry. The banks are too politically connected and stuffed to the rafters with dodgy assets from all over the Eurozone. The Germans are not alone in opposing a centralized supervisor. Austria, the Netherlands and Finland will not surrender this sovereignty either.

ECB supervision will be watered down some before the FANG agree to the scheme.

You must be logged in to post a comment.