China Credit Weathers Cash Crunch – WSJ.com.

China Leverage Risks Bypass Super-Saver Households as GDP Slows – Bloomberg.

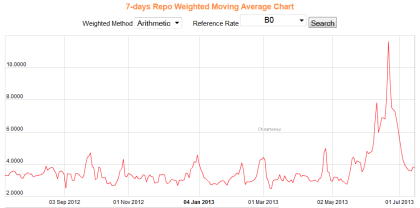

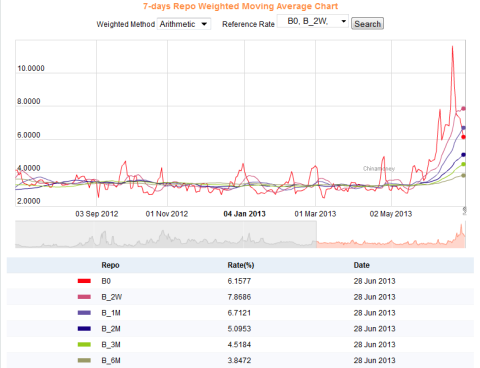

This article neglects the effects of shadow banking on credit creation. Regulated lending shows no ill effects of the cash crunch, but the PBOC’s goal in tightening the money supply was to control the growth of credit in the shadow banking system. We will discover whether or not the policy had the desired effect shortly.

China Can Endure Growth Slowdown to 6.5%, Finance Chief Says – Bloomberg.

Chinese FinMin Lowers the Bar, and Raises the Jitters.

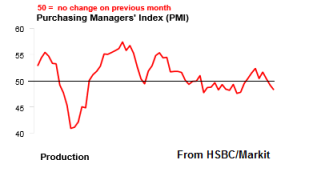

China’s official growth rate will be less than 7.5% this quarter, and the FinMin is preparing markets for a lower rate. By mentioning 6.5%, he is anchoring the media’s and trader’s expectations so that a 7.1% rate or whatever seems good in comparison. I leave you to guess at what the unofficial or real rate of GDP growth is.

Draghi Impotent as Fed Trumps ECB on Yield Curve – Bloomberg.

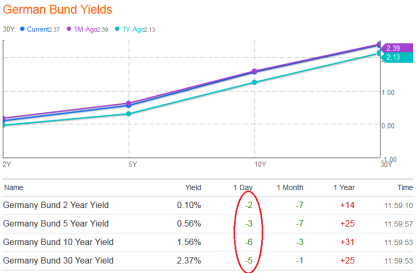

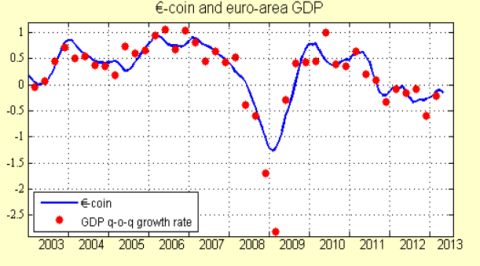

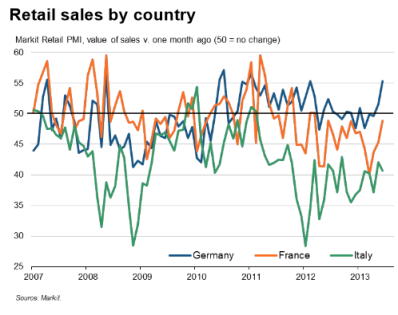

The red ellipse in the chart above shows the ever widening spread between long and short term debt in Germany, which is happening throughout Europe. Investors are beginning to realize that those long-term obligations are severely impaired in light of Europe’s woes. Debt restructurings, defaults or whatever you’d like to call them are in Europe’s future whether de facto or de jure.

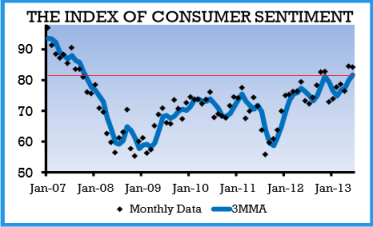

Consumer Sentiment in U.S. Unexpectedly Declined in July – Bloomberg.

Consumer sentiment slips on fears over stock prices, rates | Reuters.

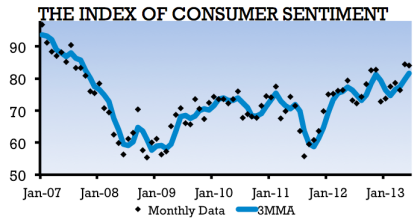

The rise in consumer sentiment seems over for now. The mainstream media calls the blip downward a “surprise,” but with a cooling economy how could anyone be caught off-guard with this move? The labor market remains in poor shape and gas prices are rising. Both Barclays and JPM have cut 2nd quarter growth forecasts to less than 1%, and poor worldwide demand seems ready to crimp growth for the immediate future. The mainstream media is surprised that this information does not fit its recovery narrative.

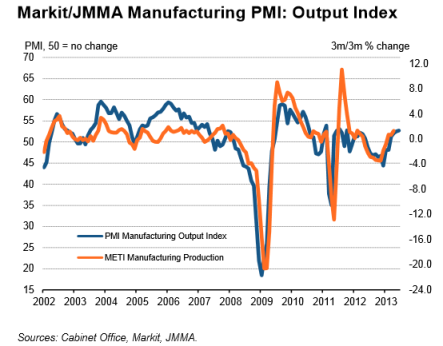

Thrift trumps Abenomics as Japan shoppers stick to bargains | Reuters.

Abenomics is running into demographic reality. Japan’s deflation is in part caused by its aging population. The young and middle aged raise families, and this is an expensive undertaking creating lots of consumer spending. The elderly do not spend money so readily. What Japan needs is not monetary inflation, but a baby boom. Unfortunately, poor economic prospects both limit the size of families and delay their start. It looks like the magic money machine can’t fix everything.

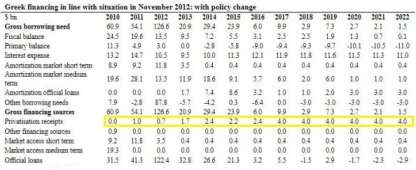

Portugal’s Bond Market Tanks as Crisis Deepens.

Whenever one of the PIIGS threatens to defy the troika, yields rise. Once investors realize that the threats are empty, the yields fall. The only leverage Portugal has is the threat to leave the euro. Since all political parties are committing to remaining within the Eurozone, there is no Plan B and no leverage to renegotiate the deal. Eventually, the opposition may gamble by supporting an exit, but not today.

You must be logged in to post a comment.